A fiduciary shall be treated as meeting the requirements of section 3 38 b ii of the employee retirement income security act of 1974 29 u s c.

Erisa section 3 38 fiduciary.

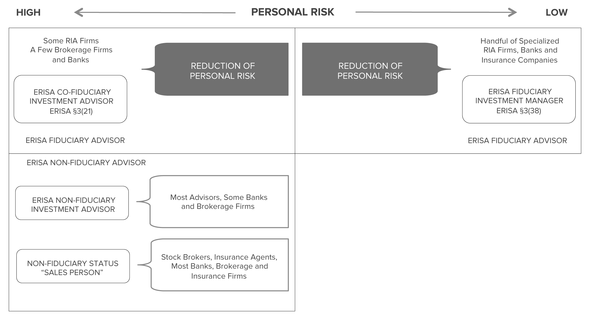

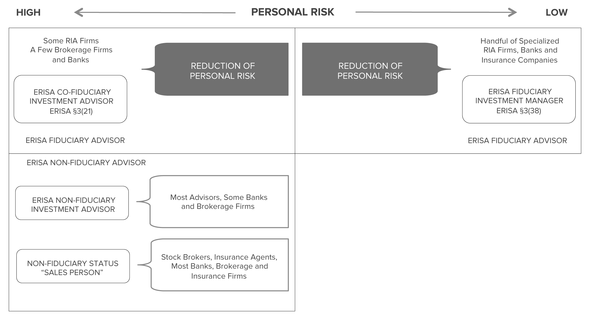

Erisa section 3 21 defines the term fiduciary and section 3 38 sets forth the requirements for serving as an investment manager to a qualified retirement plan.

A 3 38 will actually make the decisions about what to include in the plan menu implement it and then manage the investments on an ongoing basis the most important differences come down to risk and responsibility.

Whereas iron owes a duty of undivided loyalty to its clients and acts as a fiduciary under the act and erisa with respect to the provision of discretionary investment management services under.

Section 3 38 of erisaapplies to a fiduciary with discretionary controls of the plan s assets.

1002 38 b ii as amended by subsection a relating to provision to the secretary of labor of a copy of the form referred to therein if a copy of such form or substantially similar information is available to the secretary of labor from a centralized electronic or other record keeping database.

A section 3 21 fiduciary includes the plan trustee and plan administrator as further defined below.

Erisa provides that a plan sponsor can delegate the responsibility and thus likely the liability of selecting monitoring and replacing investments to a 3 38 investment manager fiduciary.

A 3 21 investment adviser is a co fiduciary role whereby an adviser provides advice to an employer with respect to funds on a 401 k investment menu and the employer retains the discretion to.

While a 3 21 fiduciary has to wait for approval for such decisions a 3 38 can go ahead and make those decisions on behalf of the client.

The 38th definition in the act erisa section 3 38 is the definition of investment manager.

This means that a 3 38 can select monitor and replace investments for the plan.

An advisor who renders discretionary investment advice to an employee benefit plan is defined as an investment manager in section 3 38 of erisa.

3 38 of the employee retirement income security act of 1974 as amended erisa.

The name of this particular fiduciary makes it easy to guess its role.

Essentially the 3 38 is responsible for selecting managing monitoring and benchmarking the investment offerings of the plan.

You can delegate most your responsibility to that fiduciary.

A 3 38 investment manager is a codified investment fiduciary on a retirement plan as defined by erisa section 3 38.

An investment manager is special type of fiduciary one who has been specifically appointed to have full discretionary authority and control to make the actual investment decisions.